.webp)

.webp)

The rules are changing fast. Get the insider guide to safer rates, lower risk, and the strategies experienced borrowers use to avoid costly mistakes.

.webp)

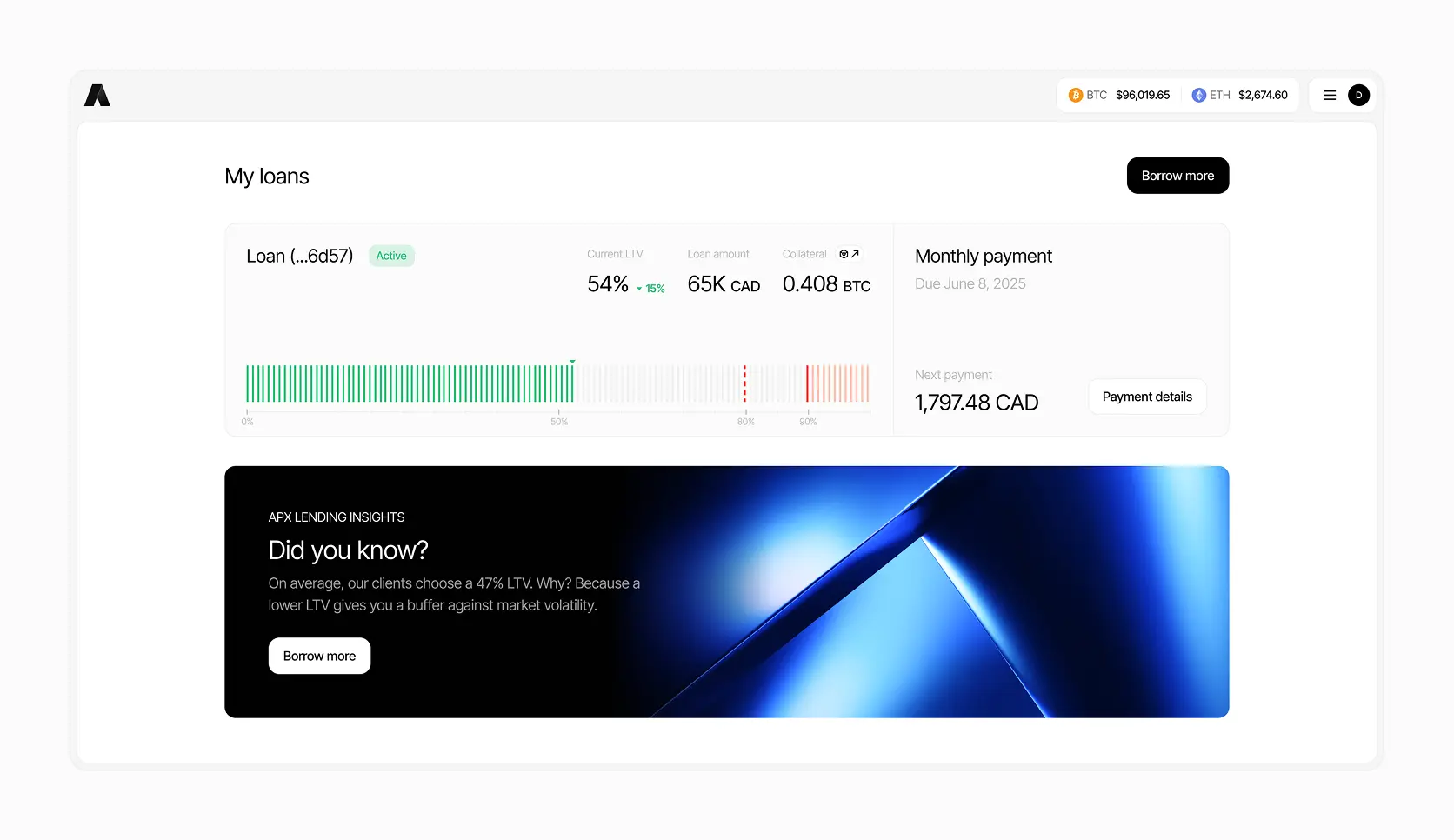

Before applying for your loan, you can get a quick estimate with our crypto loan calculator to see exactly how much you can borrow.

In Canada, the minimum loan size is C$10,000 (or USDC 10,000), and in the United States the minimum is USDC 25,000. There is no fixed maximum—loan size scales with the value of your BTC/ETH collateral and the LTV you choose.

We don’t run credit checks.

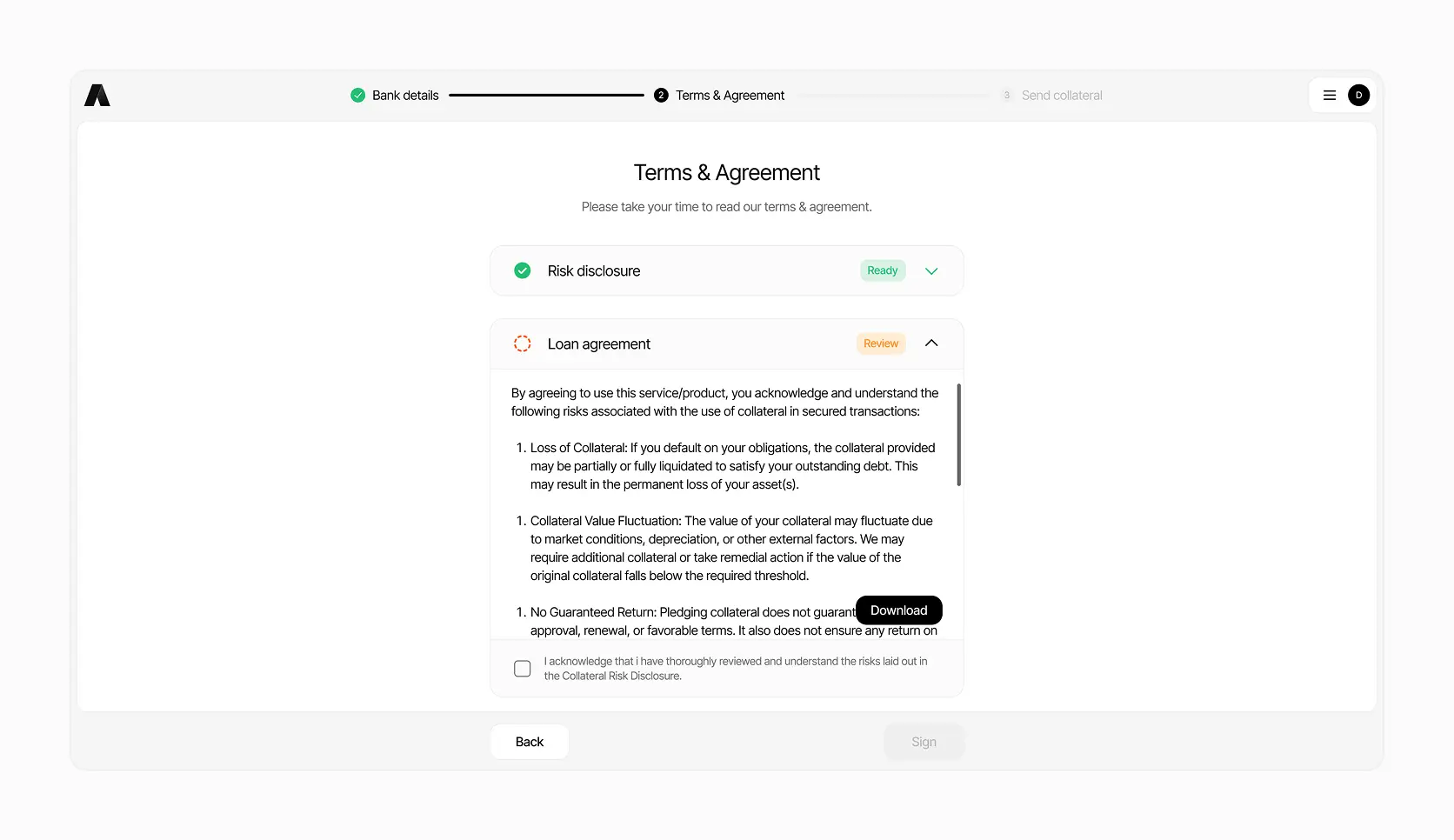

To apply for a loan, create an APX account and complete identity verification. We approve loans based on your crypto collateral and LTV, not your credit score or credit history.

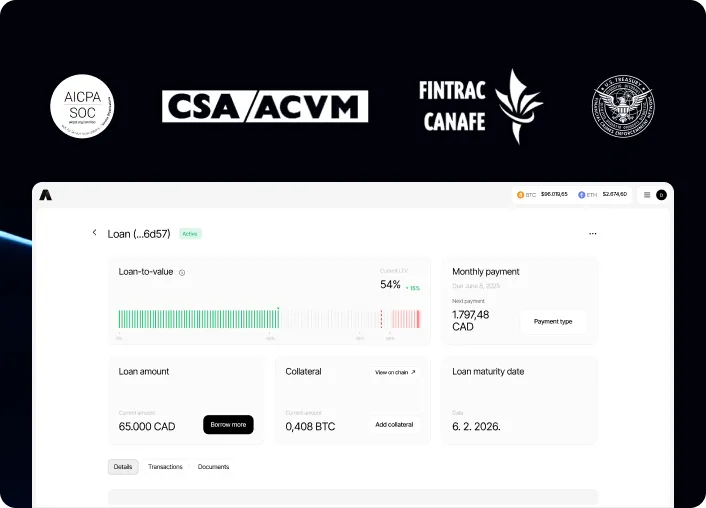

As part of standard compliance, we screen all applicants against local and international sanctions lists and complete required know-your-customer and anti-money-laundering (KYC/AML) checks.

If you’re unsure about eligibility, our team can review your situation and let you know what you qualify for, and what LTV/term makes sense.

We currently only provide loans to residents of the U.S. and Canada. That said, we're growing fast.

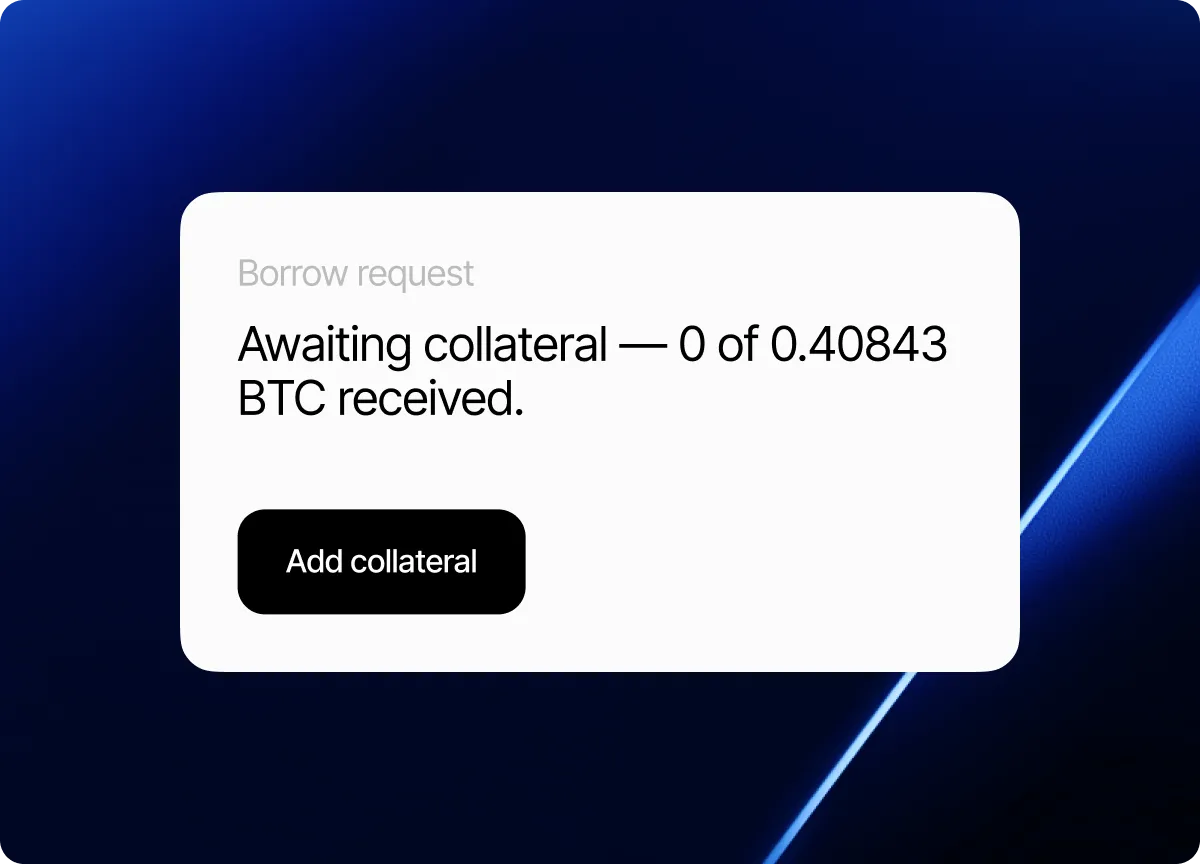

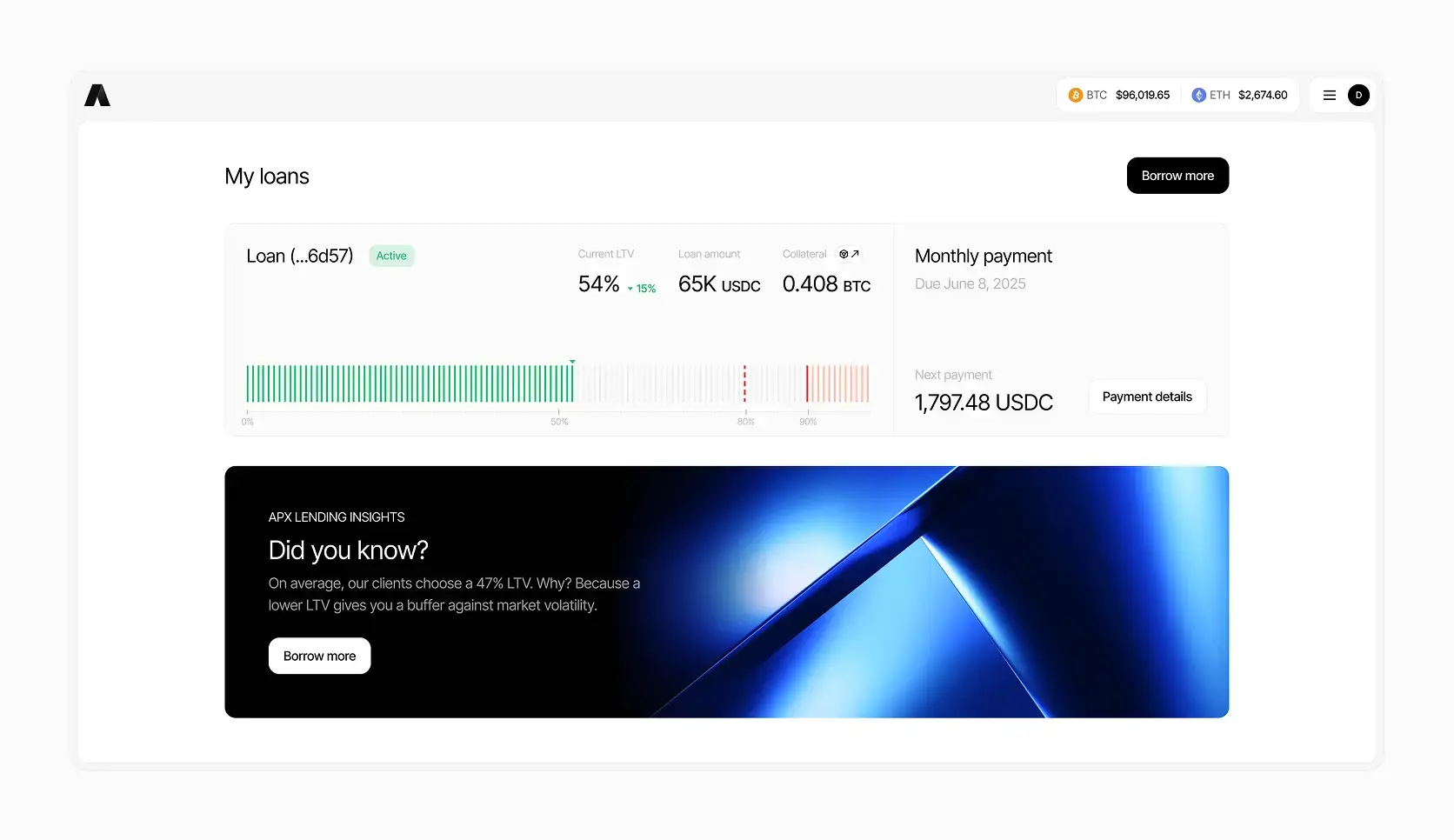

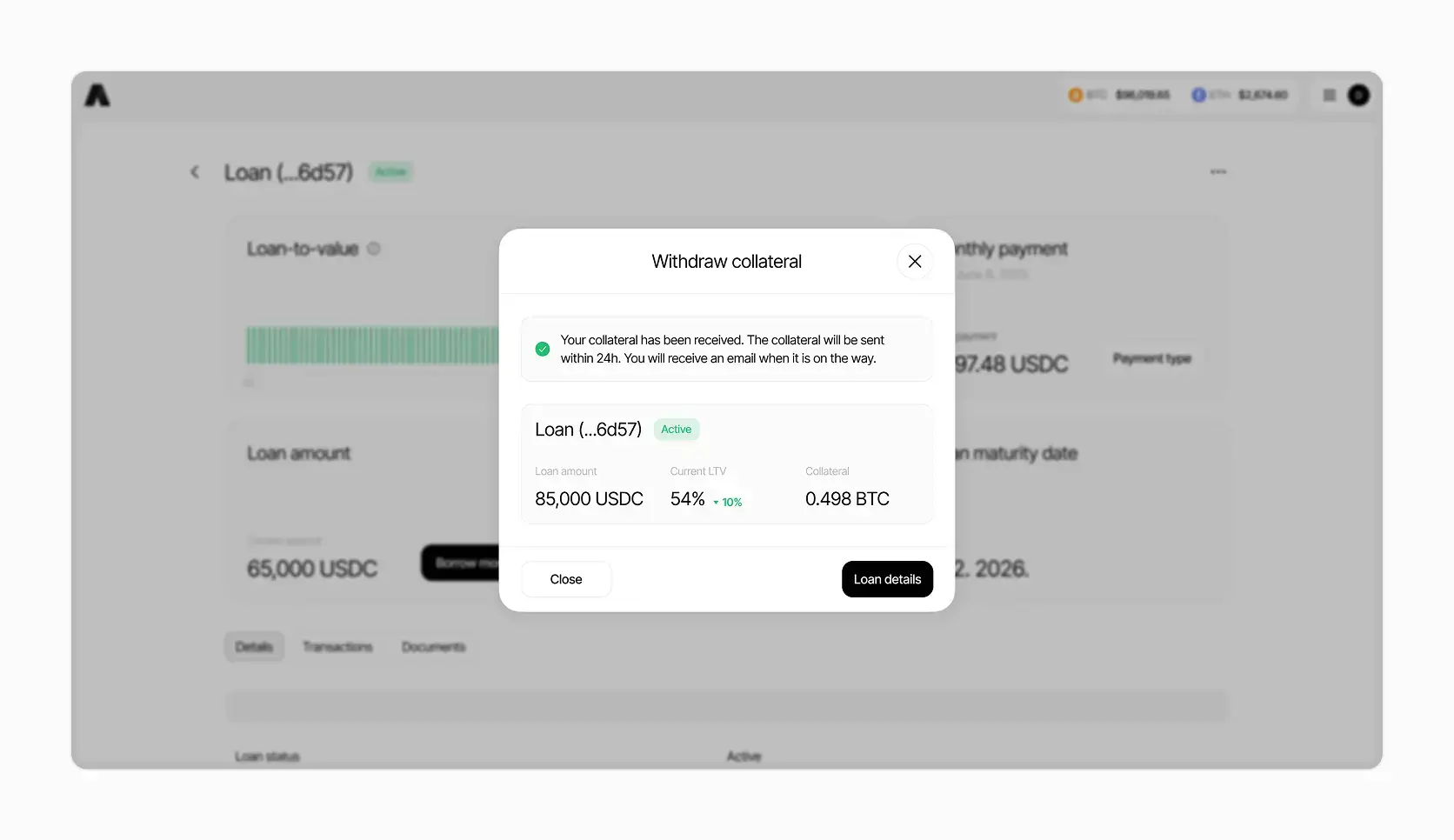

Your collateral is held in segregated cold-storage wallets with BitGo, a U.S.-based regulated custodian, with coverage up to $250M. You can see the wallet on-chain for the duration of your loan and in your APX dashboard.

The application takes less than 15 minutes. 90% of approved applicants are funded within 24 hours. After approval and collateral transfer, we wire the funds to your bank account or USDC wallet.

The loan-to-value (LTV) ratio is the percentage of your crypto’s value you can borrow as cash. At APX Lending, you can borrow 20%–60% of your Bitcoin or Ethereum’s current market value. If your LTV ever rises above 90% because the market drops, your position may be liquidated to protect against loss.